Lind Capital Partners Municipal Market Commentary

Municipal Market Performance and Benchmark Rates: In what was largely an otherwise sleepy month, August was defined by Fed Chair Powell’s dovish commentary delivered mid-month in Jackson Hole. Broader volatility was generally rangebound and controlled, though fixed income yields ended the month mostly lower, as the Fed opened the door to potential rate cuts in the months ahead. The AAA Municipal Benchmark bull-steepened in August as the 5-year maturity finished 16bps lower while 10 and 30-year maturities ended the month 6 bps and 5 bps lower, respectively. The US Treasury curve also steepened as rates were lower by 27 and 15 bps in 5 and 10 years, while rates rose 1 bp in 30 years.

The investment grade market remained resilient in August, leaning on favorable reinvestment figures and compelling absolute yields. The Bloomberg Municipal Bond Index (LMBITR) returned 0.85% in August, pulling it’s year-to-date performance into positive territory at 0.32%. High-yield municipals underperformed, for the third consecutive month, returning 0.41% in August. Year-to-date returns remain negative, at (1.31%).

Mutual Fund Flows: Municipal fund complexes experienced inflows 3 out of 4 weeks in August, extending the positive monthly fund flow momentum experienced since May. IG and HY funds have now experienced weekly inflows in 16 out of the last 18 weeks dating back to the end of April. Both investment grade and high-yield inflows eclipsed $2B in August, totaling roughly $4.5B. It’s worth noting, a significant portion of the HY inflow is attributed to the conversion/asset allocation shift into a single high-income ETF that totaled over $1.5B.

Primary Market Supply: A central and persistent theme this year has been the record breaking issuance, July was no exception. Historically, July is a lighter month for municipal new issuance, but 2025 defied historical expectations, as issuance will eclipse $50B, an increase of 35% year-over-year. While year-to-date supply is only ~15% higher versus 2024, issuance in the first half of the year (through June 30) was 55% higher versus the trailing 5-year average. While high-yield new issue totals remain subdued versus the trailing 5 and 10-year averages, especially when compared to the significant YoY increase in investment grade issuance this year, the pipeline of attractive non-rated issues endures.

Lind Capital Partners Municipal Non-Rated Market Commentary

The Brightline Train Florida saga has been in the financial press headlines throughout the summer, culminating in the mid-August refinancing of a mandatory redemption of nearly $1 billion of existing debt. Uncertainty surrounded the willingness of existing bondholders to extend debt following a summer of downgrades, deferred interest payments and operational underperformance resulted in interesting headlines and market activity.

Background: The Brightline Train is a privately owned and operated 235-mile intercity high-speed passenger rail project between Miami and Orlando. The project was “launched” in 2012 with construction beginning in 2014. Initial service between Fort Lauderdale and West Palm Beach started in 2018 and was expanded to Miami later that year. In 2023, service to Orlando International Airport began, completing the Miami-Orlando route. Stations have been added in Boca Raton and Adventura with plans for stations in Stuart and Cocoa for the future. Additionally, extending the line from Orlando to Tampa is awaiting approval and financing.

The total project cost, $5.5B, has been funded with taxable and tax-exempt debt, with different liens and different guarantors, operating and parent companies. The tax-exempt debt is widely owned throughout major mutual fund complexes, in both high yield and investment grade funds. Mutual fund portfolio managers are often attracted by their ability to acquire large blocks of bonds these “mega-issues” offer as well as the anticipated secondary liquidity a $2B+ financing offers. The deep pocketed equity sponsor, Fortress Investment Group, was likely viewed as a credit positive at the time of financing. (Many municipal market projects lack an equity sponsor with the financial resources to assist the project in times of stress or distress).

The $3.2B recapitalization including $2.2B senior secured and $1B subordinate debt was named the Bond Buyer “Deal of the Year” in 2024. The uninsured portion secured investment grade ratings Standard and Poor’s (BBB-), Fitch (BBB-) and KRBA (BBB) at the original pricing in May 2024. Downgrades started a year later, with Fitch downgrading the debt to BB+ this May and B in July. Standard and Poor’s downgraded the debt to BB+ in May and BB- in August. Finally, KBRA downgraded the debt to BB in August. The downgrade activity cited continuing operating cashflow losses, ridership lagging projections. Combined, these have greatly diminished project liquidity. As a result, the uninsured senior debt has fallen 20% in price and the uninsured subordinate debt plummeted 40% after deferring an interest payment. It has been reported that major bondholders have engaged counsel in anticipation of a potential restructuring or legal dispute with Fortress.

Out View: We typically avoid these mega-issues at original pricing and generally only participate during times of dislocation. Many of the characteristics that attract mutual fund managers to these issues repel Lind Capital. We do not have a “need” to purchase $100+ million of a given credit to put investor capital to work, and never will. We view the secondary liquidity these issues provide as a double-edged sword. Too often, mutual fund flows are not isolated to a single fund or fund complex. As a result, multiple portfolio managers often seek to sell (or buy) the same security increasing price volatility. Additionally, during periods of underlying credit stress, there are often too many sellers seeking to unload positions which leads again, to increased price volatility. Finally, while we would have viewed an equity sponsor like Fortress as a credit positive, we now recognize the risk of having a deep-pocketed adversary during credit stress.

We have always focused on issue sizes from $15 to $150 million, specifically to limit the number of other institutional holders. We find this typically enhances our yield and minimizes price volatility during market dislocations. Additionally, we believe our credit process developed over our 15+ year history and active credit surveillance allows the portfolio management team to identify and stay ahead of developing credit trends. Not having to compete with owners of $1B+ of bonds to buy or sell works to the advantage of our investors. While we find the news surrounding credits like the Brightline Train interesting, it reaffirms our commitment to our underlying philosophy and investment strategy.

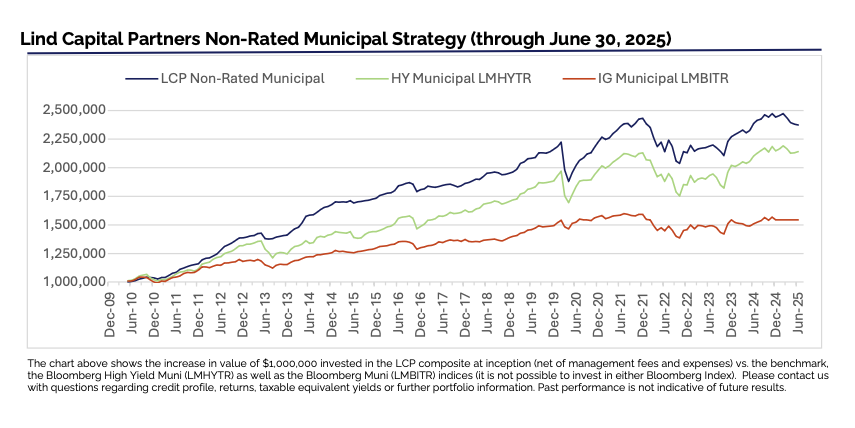

Lind Capital Partners Non-Rated Municipal Strategy

The chart above shows the increase in value of $1,000,000 invested in the LCP composite at inception (net of management fees and expenses) vs. the benchmark, the Bloomberg High Yield Muni (LMHYTR) as well as the Bloomberg Muni (LMBITR) indices (it is not possible to invest in either Bloomberg Index). Please contact us with questions regarding credit profile, returns, taxable equivalent yields or further portfolio information. Past performance is not indicative of future results.

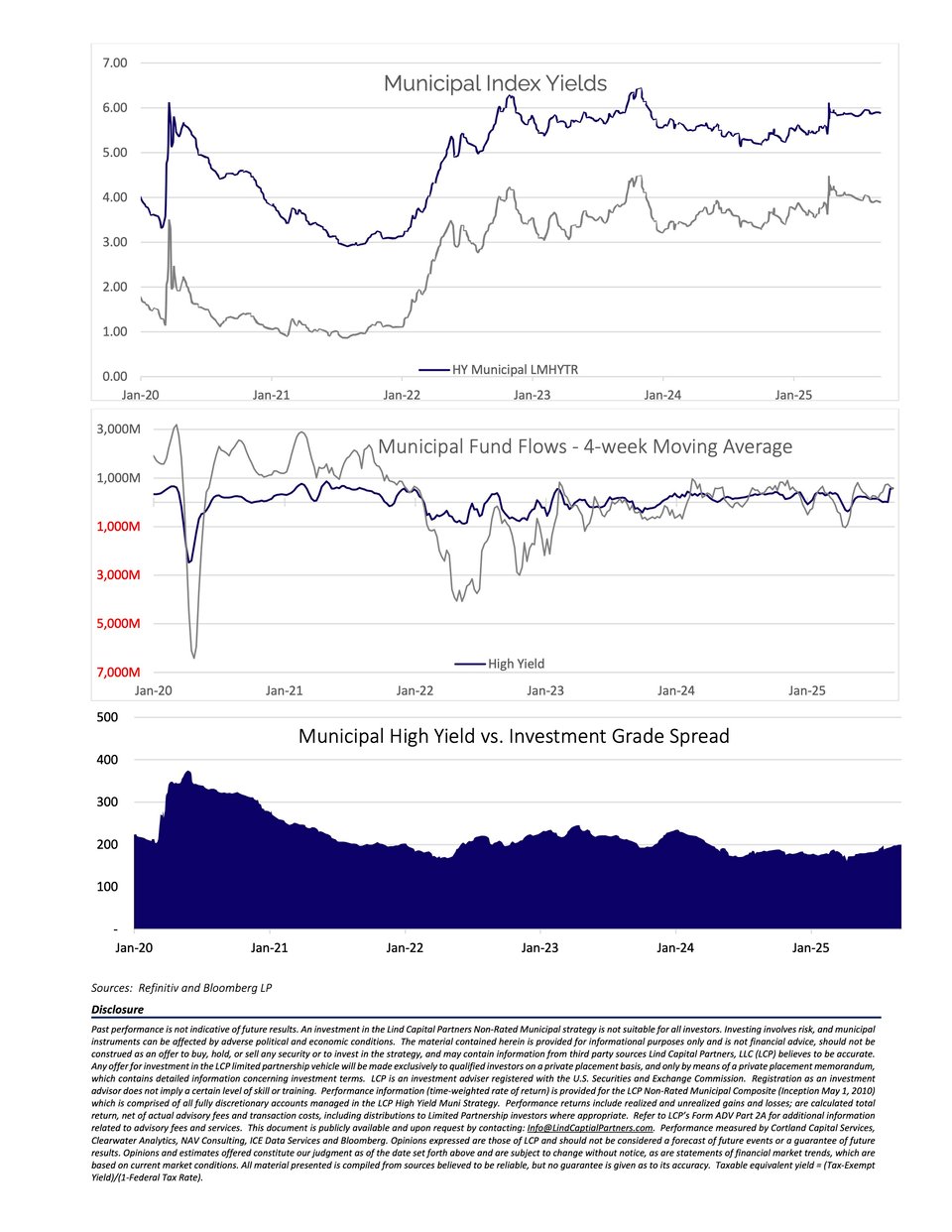

Sources: Refinitiv and Bloomberg LP