Lind Capital Partners Municipal Market Commentary

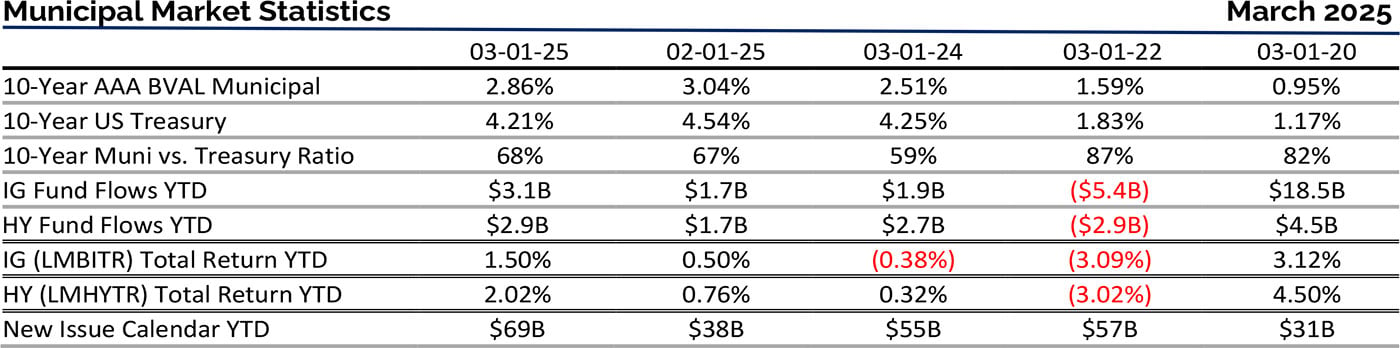

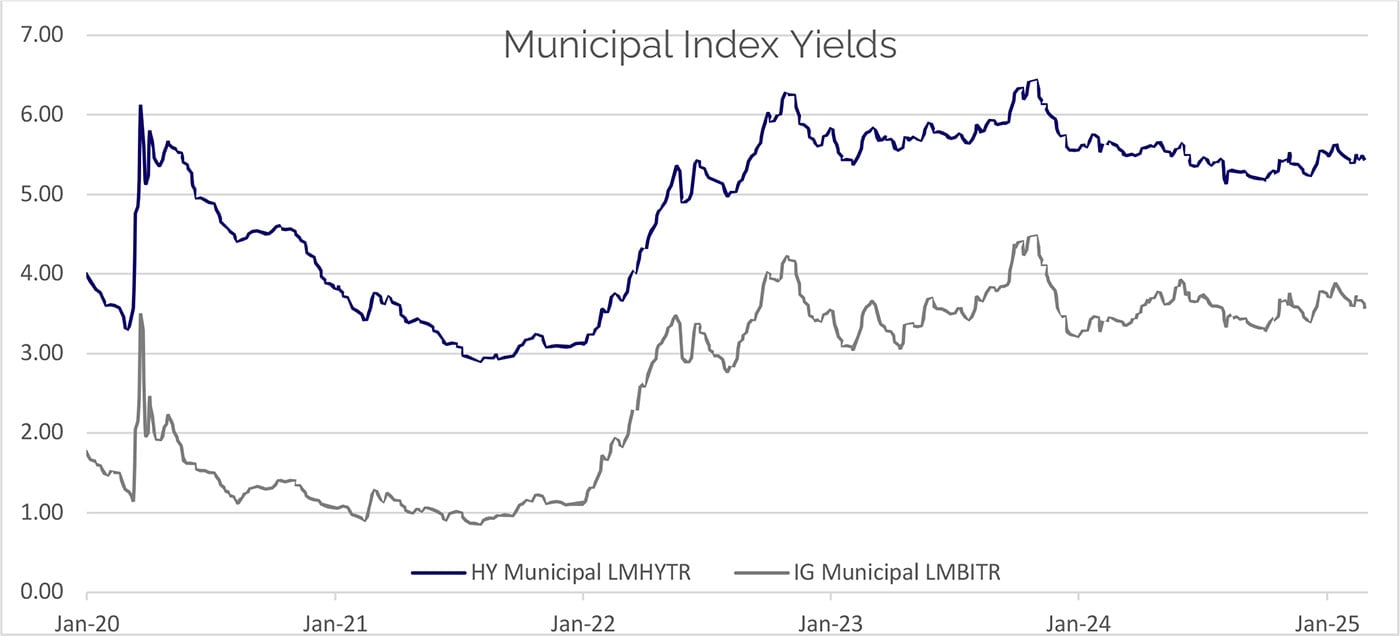

Municipal Market Performance and Benchmark Rates: Fixed-income markets are growing accustomed to persistent volatility as participants endure economic growth uncertainty and the deluge of threats and proposals out of Trump 2.0. After peaking at a yield of 4.63% mid-month, the 10YR US Treasury rallied over 40 bps to close out February at 4.22%. The short and intermediate tenors of the high-grade municipal market followed a similar path, albeit with less severity, ultimately finishing the month 18bps lower. 30-year AAA municipals underperformed, rallying only 4 bps in February.

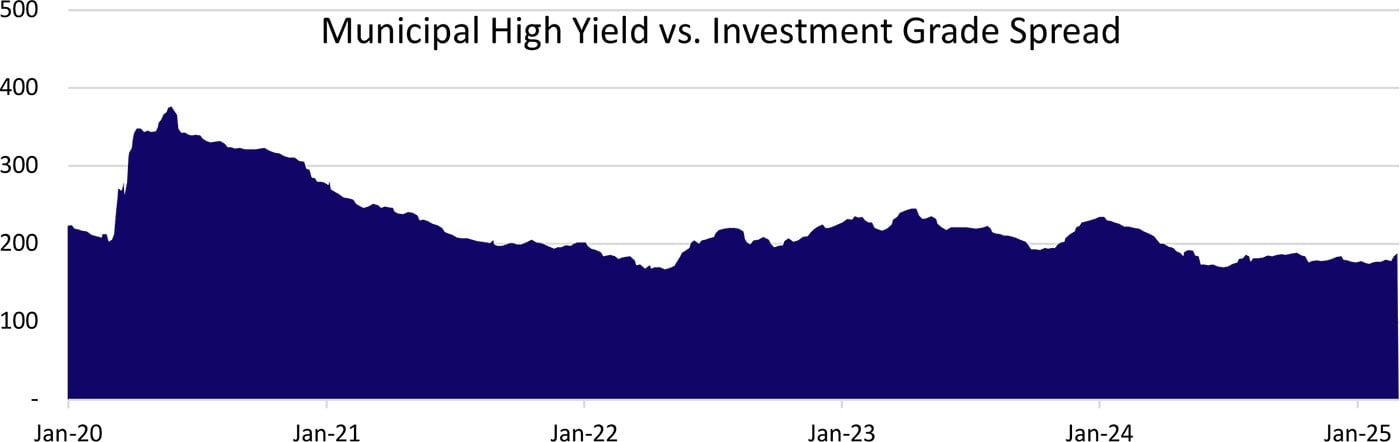

Positive performance for both the investment grade and high yield municipal indices continued in February as they returned 1.00% and 1.26%, respectively. That is the second straight month of outperformance for high yield and 11 out of the last 14 months dating back to the beginning of 2024.

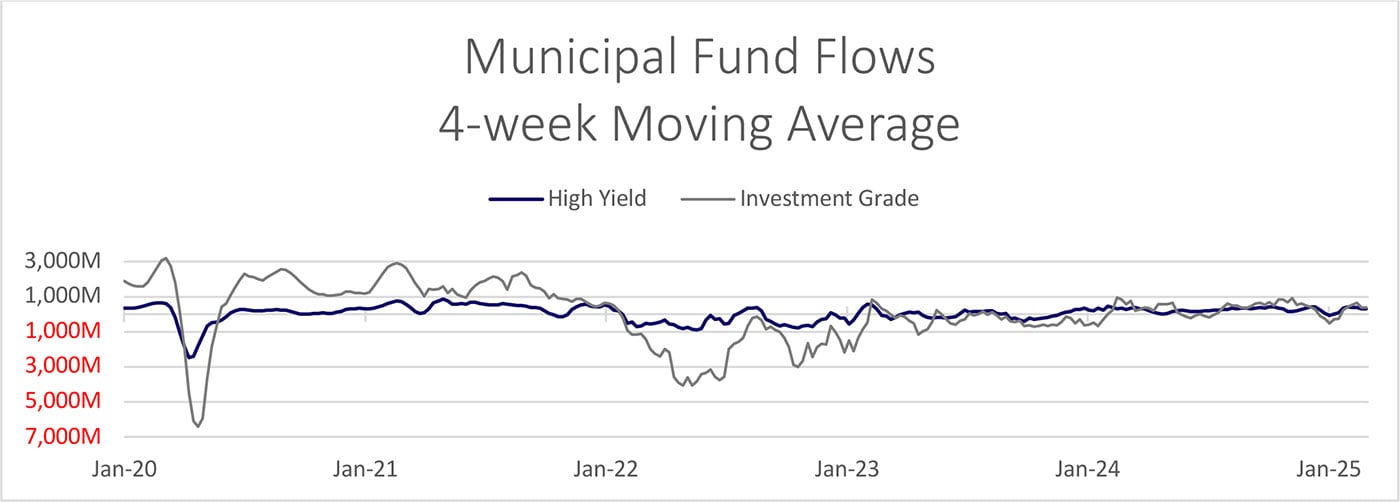

Mutual Fund Flows: The positive momentum exhibited in the latter half of January continued this month as mutual funds experienced inflows all four weeks in February, totaling $2.7B. High yield funds, which have not yet experienced a weekly outlfow in 2025, saw inflows totaling $1.25B this month. As we referenced in last month’s commentary, high yield funds garnering close to 50% of total fund flows, despite representing a fraction of the overall market, illustrates the ongoing attractiveness of the asset class.

Primary Market Supply: As expected, elevated new issue supply persisted in February as volume was upover 20% vs 2024 and exceeded the 10-year average by 35%. Heavy new issue volume continues to bedriven by borrower’s comfort level with “higher” rates, their desire to get ahead of any potential federal policy changes that could affect the municipal market, and the ever-present need to update and expand ournation’s critical infrastructure. Looking ahead, March could present a compelling entry point for investors as market technicals may be less favorable (elevated supply coupled with lower reinvestment capital) and taxrelated selling often encumbers the secondary market.

Lind Capital Partners Municipal Non-Rated Market Commentary

A common question we receive during meetings with prospects is: “Do you invest in Chicago or State of Illinois debt?” We usually answer “No, we live there and see the dysfunction first hand.” We were reminded of the query this past week when the Chicago City Council voted to issue $830 million general obligation debt. This followed the recent downgrade from Standard and Poor’s from BBB+ to BBB, two notches above junk status.There are several reasons behind our decision not to invest in Chicago GOs, primarily credit and relative value.Chicago, like all major cities, benefited significantly from federal funds during the COVID era. Now that the funding has dried up and largely been spent, the City is staring down structural deficits for the foreseeable future ($1.1B – 2026 $1.3B – 2027). Rather than address structural deficits with spending cuts, raising revenue or other budgetary reforms, the City has often relied on one-time gimmicks to balance the current budget. These include “scoop and toss”, paying off existing debt with new bond issuance essentially postponing repayment or utilizing excess TIF revenue on a one-off basis.

In addition to operating budget challenges, the City and its governmental entities have pension plans that are woefully underfunded. The four defined benefit plans are collectively 23% funded (as of December 31, 2023) with the unfunded liability totaling $37.2B (nearly $14,000 per capita). This is in addition to aggregate GO debt of $5.2B. The annual pension contribution now exceeds 23% of governmental fund revenue. Political gridlock will likely lead to greater uncertainty going forward and credit turbulence. Recently, City Council unanimously rejected the Mayor’s proposed $300 million property tax increase to address the budget deficit.Additionally, we believe there is a coming reckoning as the downtown office property market reassessment process works through the current market environment. As commercial property assessments plummet, the tax burden on residential properties will increase to offset commercial decline. This will put additional financial stress on homeowners, likely leading to greater dysfunction. The Mayor’s current approval rating within the City hovers around 6%, yes, 6%. This does not bode well for getting the things done that need getting done.

While we do not believe the City will default on it’s general obligation debt, we do believe there will be substantial credit volatility going forward. We expect the upcoming $830 million GO debt issue to be well received and most high yield funds to participate. As long-term investors we have always avoided general obligation debt because we find it challenging to analyze and quantify political and event risks at the governmental level. Additionally, we do not believe investors are adequately compensated for these risks.Rather, we focus almost exclusively on revenue bonds in 8 target sectors.

By targeting 8 revenue bond sectors, we believe we can assess and monitor the credit worthiness of ongoing business entities with services and operations that we understand. Additionally, these entities are largely, although not completely, immune from outside political interference. Our target sectors have historically been relatively insulated from economic cycles and thus somewhat recession resistant. Aging seniors do not postpone moving into congregate care due to an economic slowdown. Similarly, parents do not pull their children out of school during a recession. Most importantly, the financial status of our borrowers can be monitored on a regular basis to provide our credit team with an ongoing perspective on financial stability.

Finally, revenue bond segments of the municipal market can provide investors with a significant yield benefit over general obligation debt, particularly non-rated revenue bonds. While the general market will be clamoring for an allocation on Chicago GO bonds, we will continue to scour the market to uncover our non-rated revenue bond opportunities with tax-exempt yields between 6.50% and 7.00%. And, we will watch the ongoing City of Chicago financial drama from the sidelines as interested observers, not investors.

Lind Capital Partners Non-Rated Municipal Strategy

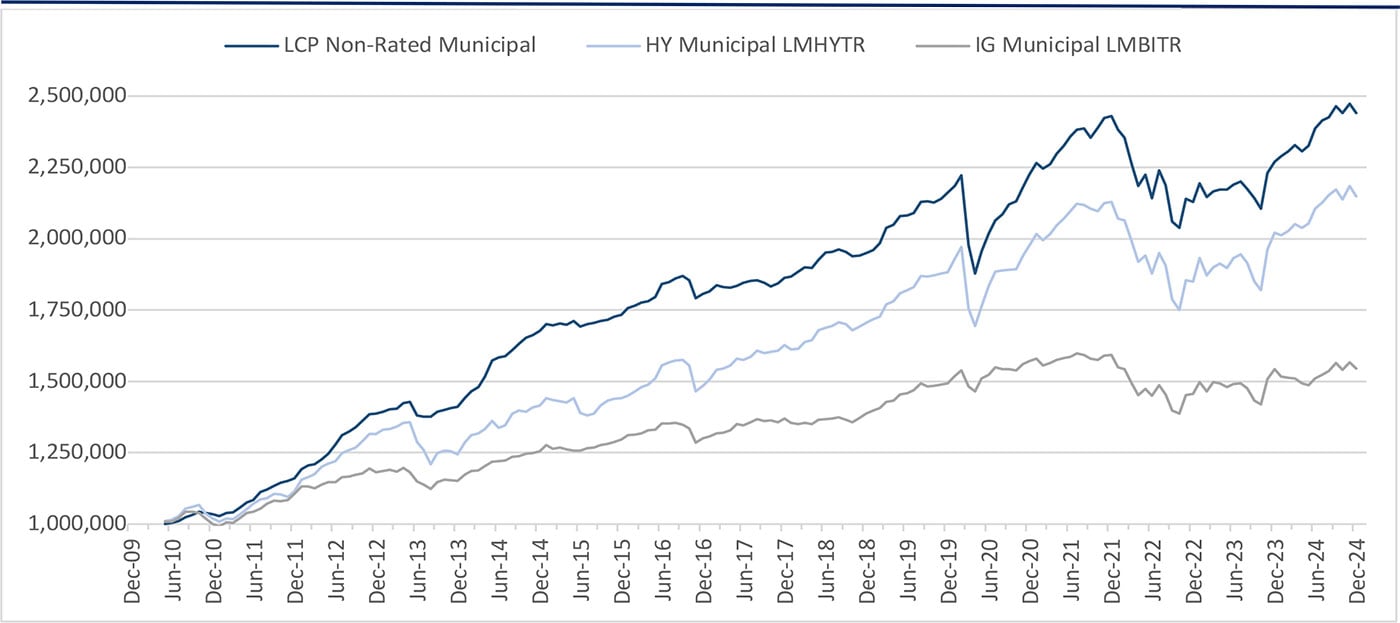

The chart above shows the increase in value of $1,000,000 invested in the LCP composite at inception (net of management fees and expenses) vs. the benchmark, the Bloomberg High Yield Muni (LMHYTR) as well as the Bloomberg Muni (LMBITR) indices (it is not possible to invest in either Bloomberg Index). Please contact us with questions regarding credit profile, returns, taxable equivalent yields or further portfolio information. Past performance is not indicative of future results.

Sources: Refinitiv and Bloomberg LP